I know it may seem like we talked about home loans not so long ago, but we felt this is an important topic to discuss again in light of the recent RBA interest rate cuts. Why? Because this is the perfect time to check the health of your home loan.

Did you know banks don’t always pass on rate cuts in full? If your bank doesn’t communicate rate changes to you or they don’t budge, you should think about shopping around for a better option – and we know of a really quick and easy way for you to do this!!

It’s this great little tool from uno Home Loans, called loanScore.

For those not familiar with uno, they are Australia’s first Active Home Loan Managers which means they proactively fight for rates for you that start low and stay low so you never need to miss out on savings again. Their dedicated team of expert brokers that will help you find a great deal and guide you all the way through to settlement. And their advanced technology, loanScoreTM will continue to monitor your home loan the whole time you have one, alerting you when you can save.

Here’s what I did to check the health of my home loan …

With loanScore, checking your home loan health is literally a 2-minute job. All you need to do is click here and:

- Fill in your loan details

- Get your loanScore

- See how much you could save

- Explore your options

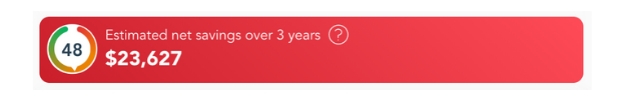

Once you have your loanScore, you’ll see whether or not you could be saving money – either with your current lender or another lender.

In my situation, my loanScore tells me I could be saving so much (and that I’m wasting a lot)! Definitely my cue to forget my outdated home loan calculator and enlist the help of a uno home loan expert!

With the help of a uno broker, moving home loans is quite straightforward. uno is with you all the way and because they have great technology it’s easy and accessible from wherever you are.

uno will take care of the whole process, and they will keep you informed every step of the way. They will take the time to understand what you really want from a lender, and use this information to seek out the lender that ticks all your boxes. They have brokers you can trust because they don’t earn personal commission, so they are always acting in your best interests.

uno will let you know what documents they need from you (you can even upload documents online) and then help you negotiate a better deal from your current lender, or switch you to a new one. Because they understand their lenders, they can work through any difficulties you feel you have, to find the right solution.

Your home loan expert will keep in touch with you beyond settlement, so you have an expert in your corner at all times. It’s about finding the right solution in a timely way to keep you on top of your mortgage, so you start on a great deal and remain on a great deal for the life of your loan.

Once you’re set up with uno Home Loans, they are on your side and on the job when it comes to making sure that you always have the mortgage that is going to deliver the result that suits your needs. uno actively manages your loan for the life of the loan, or for as long as you want them to.

You’ll receive regular updates on your loan, and if there is a better loan product available, uno will alert you to take action (if that’s what you want to do).

uno will help ensure you aren’t paying unnecessary interest … which means that you’ll be saving money and potentially paying your home loan off sooner. And if it ends up that you would be better off switching to another provider, they’ll be with you all the way; making it easy and keeping it all on track.

Imagine what you would do with the money you could save over the life of your loan! Use uno loanScore to see for yourself.

The team at Mouths of Mums are working with uno HomeLoans to bring you this article. We’re really excited about the savings uno Home Loans is helping thousands of Australian families make when it comes to their home loans so are very happy to recommend their LoanScore technology, their active home loan management and uno Home Loans in general. We’ve checked our home loans and can honestly say it’s the best thing you’ll do all month. In just a few minutes you’ll know whether or not you could be doing better with your home loan.

We may get commissions for purchases made using links in this post. Learn more.

10:37 am

8:24 pm

9:53 pm

4:26 pm

1:26 pm

11:10 am

10:24 am

9:00 am

11:03 pm

9:43 pm

8:51 pm

6:34 pm

1:04 pm

1:09 pm

9:23 pm

- 1

- 2

- …

- 4

- »

Post a comment